“Condor is ready for Brexit.”

ANDREAS GFRERER, CONDOR SALZBURG

Ready for Brexit !

How should companies that have trade relations with the UK prepare for their departure from the EU?

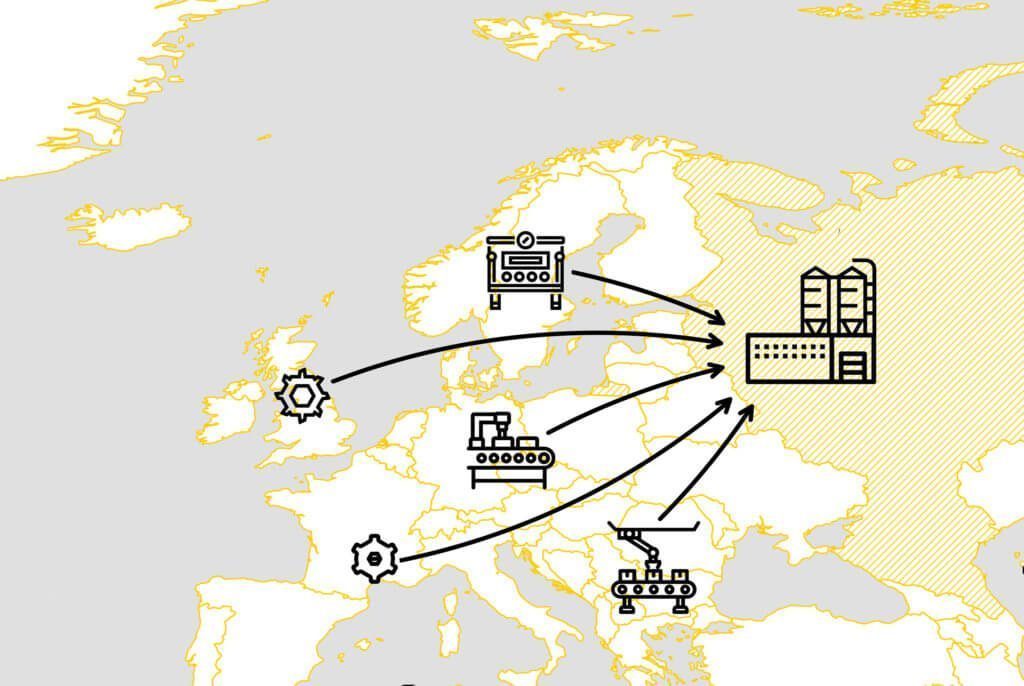

In the event that no Brexit deal materializes soon, the United Kingdom, i.e. England, Wales, Scotland and Northern Ireland, will cease to be an EU member on 30.3.2019 and leave the single market and customs union. The United Kingdom will thus return to the status of a normal, non-member country for the EU and the transport and trade of goods would need to be strictly regulated for customs clearance.

Condor is prepared for such a scenario and prides itself on being a specialist in all customs matters thanks to its high volume of third-state, non-EU transports. In future, this expertise may also prove to be relevant to trade with the United Kingdom. Exporting companies there, in particular, are sure to be confronted with questions on customs formalities such as customs controls, customs declarations, rules of origin as well as restrictions.

The following checklist can provide guidance on how to prepare for trade with the UK following Brexit:

- Is your company familiar with doing trade with third/non-EU countries?

- Do you have an EORI number?

- Are you a participant of any e-customs handling systems, or is there a forwarder or customs representative available to assist you?

- Do you have an authorized Location of Goods?

- Is the “customs tariff number” of the import / export goods known?

- Are you aware of the customs duties for the imported goods?

- Regarding trade fairs and professional equipment: Are you familiar with the Temporary Customs Procedure or the ATA Carnet?

- Are the import / export goods subject to prohibitions or restrictions in cross-border trade with third/non-EU countries (e.g. dual- use, etc.)?

We can assist you with the transition and provide the following:

- Experience as well as state-of-the-art e-customs handling systems for customs clearance

- AEO certification by the Austrian Customs Authority

- Union and Common Transit (CT): This provides the option of customs clearance at the final destination of the goods. There are no lengthy customs clearance procedures at the border. When crossing the border, it is only checked whether the shipping document is present, and closures are sealed and untampered. This option significantly reduces the much-feared, long waiting times at the border by trucks. [link]

- Customs authorized location of goods at your place of residence. The goods need not be brought to a customs office or forwarding agent for customs clearance. Your goods are cleared at your own home.

English

English