„Passports for Goods“ or „Merchandise Passports“

The ATA Carnet is an international customs document that permits the duty-free and tax-free temporary export and import of goods for up to one year. The Initials „ATA“ are an acronym of the French and English words „Admission Temporaire/Temporary Admission“.

Carnet ATA

The ATA Carnet is an international customs document that permits the duty-free and tax-free temporary export and import of goods for up to one year. The Initials “ATA” are an acronym of the French and English words “Admission Temporaire/Temporary Admission”.

ATA Carnets cover:

- Commercial samples

- Professional equipment

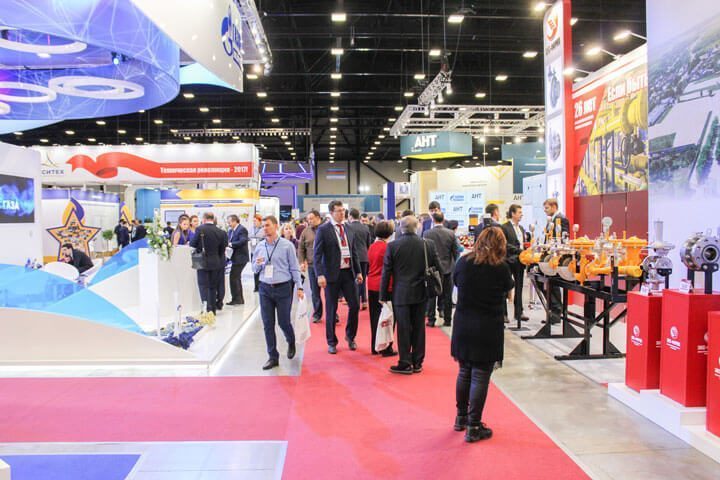

- Goods for presentation or use at trade fairs, shows, exhibitions and the like.

How does the Carnet ATA work ?

The ATA Carnet is composed of a front and back covers and includes two sheets for presentation at each foreign country you are visiting and two sheets for presentation to customs when leaving and returning to your home country.

You give one sheet to the foreign customs officials when you enter their country and the other when you leave it. The same applies when exiting and entering your own country.

Carnets apply to three broad categories of merchandise: commercial samples, professional equipment and goods for use at exhibitions and fairs. With the exception of perishable or consumable items, the product range is nearly limitless. Carnets are regularly used to facilitate movement of everything from display booths to racing yachts.

Individuals or firms wishing to use a carnet to move goods in and out of foreign countries must submit an application and the necessary collateral to their home NGA. In the US the applicant must post cash or surety bond equal to 40% of the value of the goods traveling on the Carnet. All bonds must be issued by government approved companies as listed on the Department of the Treasury’s Circular 570, be licensed in the State of NY, and have an AM. Best rating of A- or above.

The application, among other things, lists all countries of intended transit and all applicable goods with their assigned values. If the application is properly completed and submitted with the applicable fees the NGA will issue a carnet specifically tailored to that itinerary. The carnet document has two, green, cover leaflets denoting country of origin with instructions. Within the covers are counterfoils and vouchers for each country to be transited. The vouchers act as receipts for entry and re-export in foreign countries and are kept by foreign customs officials. The counterfoils are stamped by the foreign customs services and act as the carnet holders receipt. Upon completion of travel or expiration of the carnet’s 12-month active period, the holder must return all documents to their home NGA. A review is conducted. If all documents are in order and no claims are found to be forthcoming from one of the applicable foreign countries, the collateral can be returned. If a bond was used the NGA issues notice that the bond may be canceled. If the counterfoils, including the final one showing re-entry of all applicable goods back into the country of origin, are not in order, or if a foreign customs service notifies the NGA of a violation, the carnet holder is given notice to provide proper documentation or pay the applicable duties. If they do not, the collateral or bond are used to pay the claim. Claims that can not be amicably settled between the applicable NGAs may be referred to the ICC for Dispute Resolution Services.

Deutsch

Deutsch  English

English